The BC Arts Council, our arts and culture partner, offers programs that serve various creative industries supported by Creative BC. The BCAC's Project Assistance: Professional Arts Festivals grant program supports eligible organizations and arts or curatorial...

Related News

Producing for the Planet Launches Greening the Screen: An Action Guide for Canadian Media Producers

Producing for the Planet, a coalition of Canadian independent media producers who are making a commitment to act on climate change has launched an action guide and resources to empower and unite producers in being a leading force for positive environmental change. As...

Lights, Camera, Nature: B.C. Motion Picture Industry Funds 7 New Park Projects

The fourth annual REEL Earth Day Challenge has raised $100,000 toward projects delivered through Metro Vancouver Regional Parks Foundation. Since 2021, the annual BC film industry fundraiser for parks and greenspaces has raised over $473,000. “Creative BC's Reel...

Apply for the Ohsoto’kino Music Incubator

This five-day artist development intensive is open to Indigenous artists across Canada. Each year, six participants will converge at Calgary's Studio Bell, home of the National Music Centre, to learn new skills and connect with national music industry experts. This...

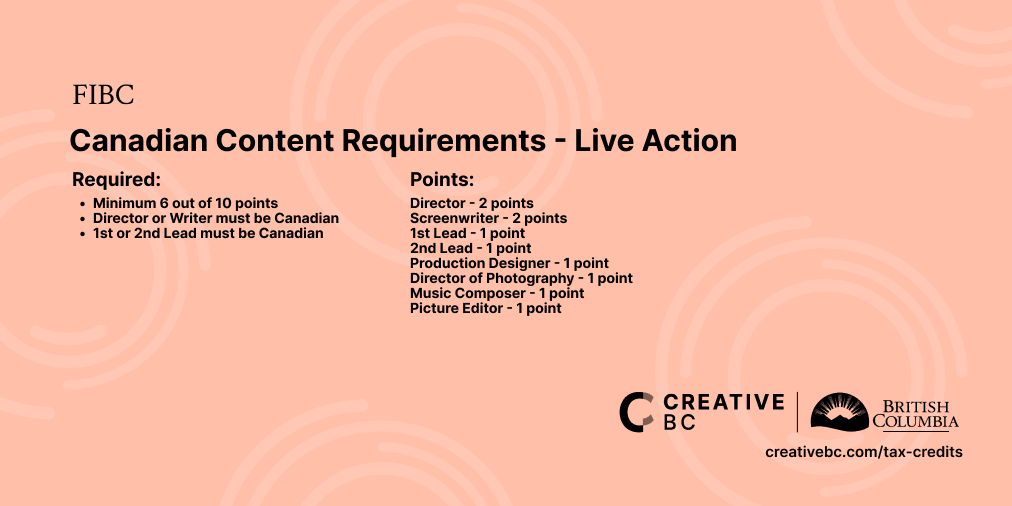

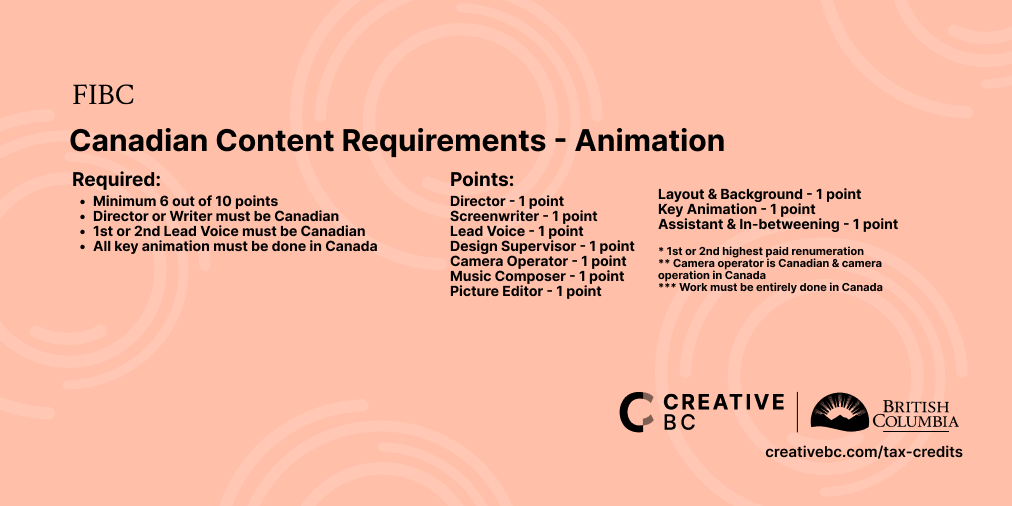

FIBC Tax Credit Applicants: Canadian Content Points

Are you planning your next Canadian content production? Be sure to know the Canadian Content rules.

Under Film Incentive BC, a production that is not an international treaty co-production must be allotted at least 6 Canadian content points by the certifying authority; or, if the production is a documentary with less than 6 points, all creative positions applicable to the production are occupied by Canadians. Note that under the Regulations, “Canadian” (with respect to the Canadian content requirements) includes Permanent Residents of Canada.

Canadian content points are allotted as following:

For a live action production:

- Director – 2 points 1

- Principal screenwriter – 2 points 1, 2

- Lead Performer for whose services the highest remuneration was payable – 1 point 3

- Lead Performer for whose services the second highest remuneration was payable – 1 point 3

- Art Director – 1 point

- Director of Photography – 1 point

- Music Composer – 1 point

- Picture Editor – 1 point

For an animation production:

- Director – 1 point 1

- Lead Voice for whose services the highest or second highest remuneration was payable – 1 point 3

- Design Supervisor – 1 point

- Camera Operator if the Camera Operation is done in Canada – 1 point

- Music Composer – 1 point

- Picture Editor – 1 point

- Principal screenwriter and Storyboard Supervisor – 1 point 1

- Where the layout and background work is done – 1 point 4

- Where the key animation is done – 1 point 4, 5

- Where the assistant animation and in-betweening is done – 1 point 4

1 The director or the principal screenwriter must be Canadian.

2 The principal screenwriter of a production is deemed not to be a Canadian unless each individual involved in the preparation of the screenplay for the production is a Canadian, or the principal screenwriter is an individual who is a Canadian and the screenplay for the production is based on a work authored by a Canadian and published in Canada.

3 The lead performer (or voice) or the second lead performer (or voice) must be Canadian. A lead performer is an actor who has a leading role in the production having regard to the performer’s remuneration, billing and time on screen; a lead voice is the voice of the individual who has a leading role in the production having regard to the individual’s remuneration and the length of time that the individual’s voice is heard in the production.

4 Canadian content points are to be allotted if the country where the work is completed is Canada.

5 Key animation must be completed in Canada.

Where multiple people share duties and/or screen credits for a single position, the production only earns the point(s) if all of the people sharing the duty and screen credits are Canadian. For example, if there are two editors on the production, the editor point will only be allotted if both editors are Canadian.

For more information, please review Section 2-6 of Income Tax Act (BC) Film and Television Tax Credit Regulations.

Joanne Chow

Senior Business Analyst, Motion Picture Tax Credits

jchow(at)creativebc.com

This post is intended as a general overview. It is not exhaustive and should not be relied upon to determine eligibility or the final amount of an anticipated tax credit. In case of any discrepancies between this post and the Income Tax Act (BC) and Regulations (the “Act”), the provisions of the Act prevail.

Stay Connected

Subscribe to our newsletters